In recent years, the financial landscape has witnessed a transformative shift with the emergence of innovative FinTech companies aiming to revolutionize traditional banking. Two prominent players in this domain, N26 and Revolut, have garnered significant attention for their user-friendly mobile banking services. In this blog post, we’ll delve into the key features and differences between N26 and Revolut to help you make an informed decision about which might be the better fit for your financial needs.

N26: The European Banking Darling

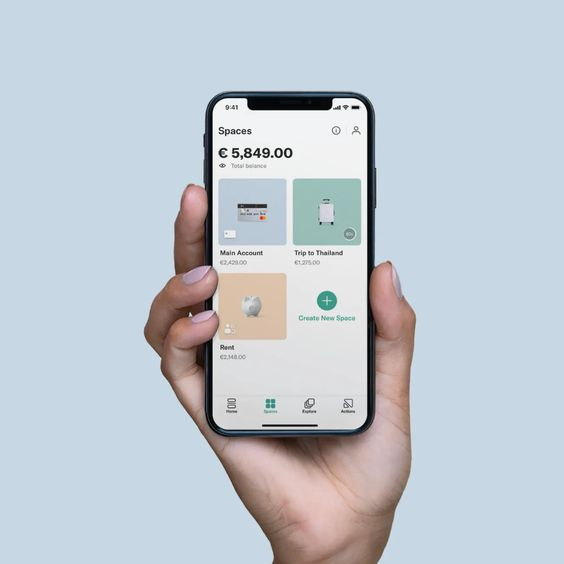

Sleek Design and User Interface: N26 boasts a minimalist and intuitive user interface, making it easy for users to navigate through their financial activities seamlessly. The app’s design is sleek, reflecting a modern approach to banking.

Global Banking Experience: One of N26‘s strengths lies in its ability to provide a global banking experience. With a presence in various European countries and partnerships worldwide, users can travel without worrying about hefty international fees.

Comprehensive Account Offerings: N26 offers various account types, including free and premium options, each tailored to different needs. The premium accounts come with added perks such as travel insurance, partner discounts, and enhanced withdrawal limits.

Remote Work or Travel With N26

Global Accessibility: N26 provides a seamless global banking experience. With its wide acceptance in various countries and the ability to make transactions in multiple currencies at competitive rates, it’s an excellent choice for remote workers who frequently deal with international transactions.

Travel-Friendly Features: N26‘s travel-friendly features, such as no foreign transaction fees and access to interbank exchange rates, make it advantageous for those working remotely from different locations worldwide.

Mobile App: The N26 mobile app is user-friendly and allows you to manage your finances on the go. You can easily track your expenses, set budgets, and receive real-time notifications for transactions.

N26 Business: If you’re a freelancer or run a small business remotely, N26 offers business account options with features like expense categorization and in-app accounting tools.

Revolut: The Disruptive Challenger

Currency Exchange and Travel Benefits: Revolut gained early recognition for its standout feature – no foreign exchange fees. Users can exchange currencies at interbank rates, making it an excellent choice for frequent travelers or those dealing with international transactions.

Cryptocurrency Integration: Revolut stands out for its cryptocurrency integration, allowing users to buy, sell, and hold various cryptocurrencies within the app. This feature caters to the growing interest in digital assets.

Budgeting and Analytics: Revolut places a strong emphasis on financial management, offering features like budgeting tools, spending analytics, and round-up transactions. This appeals to users seeking a comprehensive overview of their financial habits.

Remote Work or Travel With Revolut

No Foreign Exchange Fees: Revolut is renowned for its no foreign exchange fee policy. Remote workers can benefit from this feature when dealing with international clients or managing expenses in different currencies.

Cryptocurrency Integration: For those involved or interested in cryptocurrencies, Revolut‘s integration allows you to buy, sell, and hold various digital assets directly within the app. This can be convenient for managing diverse financial portfolios.

Expense Management: Revolut‘s app offers robust expense management tools, including budgeting features, spending analytics, and automatic categorization of transactions. This can be particularly useful for keeping track of remote work-related expenses.

Virtual and Physical Cards: Revolut provides users with both virtual and physical cards. The virtual card is handy for online transactions, while the physical card can be used for in-person purchases or ATM withdrawals.

Points of Comparison

Fees and Pricing: Both N26 and Revolut offer free basic accounts with optional premium plans. Understanding the fee structures, including ATM withdrawal limits, foreign exchange fees, and account management costs, is crucial for making an informed decision based on your usage patterns.

Security Measures: Given the nature of digital banking, security is paramount. Evaluate the security features offered by both platforms, such as two-factor authentication, biometric login, and fraud protection, to ensure the safety of your financial data.

Customer Support: In the event of issues or queries, responsive customer support is invaluable. Consider the reviews and experiences of users with each platform’s customer service to gauge the level of support you can expect.

Considerations for Remote Work:

Security: Ensure that you follow recommended security practices, such as enabling two-factor authentication and using secure connections, to protect your financial information while working remotely.

Network Coverage: Check the network coverage of both cards in the locations where you plan to work remotely. Both N26 and Revolut rely on internet connectivity for real-time updates and transactions.

Account Types: Evaluate the features of the different account types offered by both platforms, including any premium plans, to see which aligns best with your remote work needs.

Ultimately, whether you choose N26 or Revolut for remote work will depend on your specific preferences, travel habits, and financial priorities. It’s advisable to explore the features of each platform thoroughly and consider any fees, security measures, and additional services that may benefit you in a remote work setting.

Maximizing Your Money: How N26 and Revolut Can Save You Hundreds!

In the dynamic world of FinTech, N26 and Revolut emerge as powerful tools not just for convenience but also as savvy companions for saving big bucks. Picture this: By seamlessly navigating through the features of N26 and Revolut, you could potentially reclaim hundreds of dollars that would otherwise be lost to fees and unfavorable exchange rates.

N26‘s commitment to zero foreign transaction fees and competitive exchange rates ensures that every dollar spent internationally stays in your pocket.

Meanwhile, Revolut‘s disruptive stance extends to no hidden fees, empowering users to make transactions globally without the financial sting.

The result? An opportunity to save significant sums, turning your everyday financial transactions into a source of potential savings.

Conclusion

Choosing between N26 and Revolut ultimately depends on your individual financial preferences and requirements. Whether you prioritize a sleek user interface, global banking capabilities, travel benefits, or cryptocurrency features, both platforms have unique offerings. Take the time to assess your needs and priorities to determine which FinTech champion aligns better with your financial goals. The future of banking is undoubtedly digital, and N26 and Revolut are leading the charge, offering users a modern, accessible, and flexible banking experience.